How to claim Gift Aid for the first time

Claiming Gift Aid won't be taxing with this guidance...

HMRC research suggests that 25% of charitable donations that are eligible for Gift Aid are not Gift Aided. This is especially likely to be the case for donations to small charities. So here is a guide for small charities on the advantages of Gift Aiding donations, which donations can be Gift Aided and how to make your first Gift Aid claim.

Gift Aid can only be claimed on donations made by UK income tax and capital gains tax payers. Gift Aid is a repayment of the UK basic rate income tax a UK income taxpayer paid on their gift, however the tax is repaid to the charity, not the donor. For example, for a donation of £100, the basic rate (20%) Income Tax paid was £25 (£125 x 20% = £25, £125 – £25 = £100). The charity thus receives Gift Aid at a rate of 25% as long as the basic rate of income tax is 20%.

Higher (40%) and additional rate (45%) taxpayers also benefit as they receive tax relief for their Gift Aid donations. For example, a higher rate (40%) taxpayer donating £100 under Gift Aid should receive further tax relief of £125 x (40% – 20%) = £25.

When is a donation eligible for Gift Aid?

For a donation to be eligible for Gift Aid, the following must apply:

- It must be a monetary donation (i.e. cash, card payments, bank transfers etc., but not gifts of goods or services)

- The donation must be made to a UK or EU/EEA recognised charity. If the charity is required to be registered with a charity regulator (such as the Charity Commission) it must be so registered

- The donor must give the charity a valid Gift Aid declaration in respect of the donation. The declaration can be given before, at the same time as, or up to four years after the donation. This means you can claim Gift Aid on eligible donations made within the last four years as well as on current and future donations. Always use the up to date HMRC model Gift Aid declarations. Check the donor has completed the declaration correctly and retain for at least six years after the last donation to which it applies or longer if it will apply to future donations

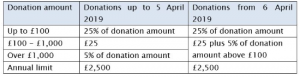

- The donor, or a person connected to the donor, must not receive a substantial benefit in consequence of making the donation. So, you can provide donors with minor incentives but not with substantial benefits. The maximum value of benefits provided must not exceed the following limits

How to register for Gift Aid and make claims

The charity must first be registered with HMRC as a charity. This is now done by completing an online application form. Once HMRC has decided to recognise the charity, HMRC should send an activation code through the post. You can then use this code to add the Charities Online service to the charity’s HMRC online account. Gift Aid claims are then normally made via the Charities Online service.

There are then three ways to make Gift Aid claims:

1. Direct database claims Some software products can make claims directly to the Charities Online service, for example certain specialist donor management products. The software submits the claim at the click of a button.

2. Spreadsheet claims if you do not have software that can do this the next option is to submit a spreadsheet claim. You must first download the appropriate HMRC template spreadsheet, fill in details of donors and their donations, then upload the completed spreadsheet to the HMRC Charities Online service.

3. It is also possible to send paper claims through the post, but you must first obtain copies of the paper form CR1 from the HMRC charities helpline service. You then complete and submit the forms to the address on the for

HMRC should then pay the Gift Aid by BACS within:

- four weeks if you claimed online

- five weeks if you claimed by post using form ChR1

Find out more about our finance products and services