Do you know how much the employer NI changes are costing you?

Ross Palmer from Sayer Vincent explains how the changes to employer NI impact charities.

In Autumn 2024, the Government announced a number of changes to employer national insurance contributions (NICs) which will result in many organisations having to make increased contributions.

But due to the nature of these changes, working out the additional cost is not as simple as scaling up the total employer NIC by the increase in the rate and the overall increase in cost for different organisations can vary significantly depending on their size and average salary cost.

The changes

There are three changes to employer NICs from 6 April 2025:

- The rate of employer NICs payable on employee earnings increased by 1.2 percentage points from 13.8% to 15%.

- The earnings threshold after which employer NICs are due decreased from £9,100 a year to £5,000 a year.

- Changes to the employment allowance, increasing this from £5,000 to £10,500 a year, as well as removing the existing restriction that prevented organisations with a liability above a certain size from claiming it.

It is a combination of the first and second change which can make it difficult to establish the cost to the organisation. The first increases the overall rate, but the second increases the amount of earnings on which NICs are due, which can represent a much more significant cost.

Example – Individual employee

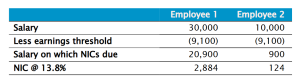

To illustrate the impact of salary on the additional cost, let us look at the additional cost for two employees. Under the 2024/25 rules, the employer NICs due would be calculated as follows:

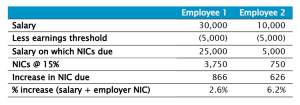

Under the new rules, from 6 April 2025 employer NICs would be calculated as follows:

As might be expected, the additional NIC cost is greater for the higher paid employee. But when looking at the percentage increase in staff cost, this is far more significant for the lower paid employee!

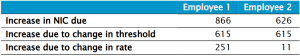

This is because of the change to the earning threshold – which means that NICs are due on a much higher proportion of their salary. And it is this part of the change that has the greater impact for most employees as shown below.

The good news – the employment allowance

While the employer NI costs are increasing, the government also announced two changes to the employment allowance, which is deducted from the total national insurance contributions paid by employers and is claimed via the payroll reporting made to HMRC.

- The allowance itself is increasing by £5,500, to £10,500.

- Currently larger organisations/groups of charities/companies, which have total employer NICs of over £100,000 per year cannot claim the allowance. However, from 6 April 2025 this restriction will be removed, allowing more organisations to claim the relief.

For larger organisations, being able to claim the relief will provide a degree of mitigation against the increase. For some smaller organisations however, it is possible the increase may result in a decrease in employer NI costs.

Example

A charity with 5 staff on £30,000 per year would pay increased NICs of 866 x 5 = £4,330.

However, they would be able to claim additional employment allowance of £5,500 per year.

This results in a net saving of £1,170.

Assessing the cost for your organisation

There are two options for assessing the increased cost for your organisation:

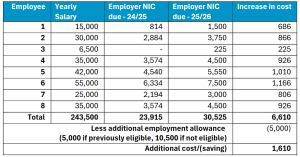

- Recalculate NIC due for each member of staff on a yearly basis. This requires gathering staff salaries on an employee-by-employee basis and recalculating as below, including netting off any saving on the employment allowance.

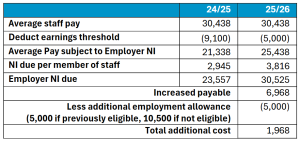

- Estimate the NIC due, based on total staff costs and average staff numbers, netting off any employment allowance saving. Using the total staff pay of £243,000 above and based on there being 8 employees.

- This method is only an estimate, and where there are staff paid below the earnings threshold (such aspart-time, or seasonal staff)this can vary from the employee by employee method, butshould in most cases still provide an appropriate figure for estimation purposes.